Government Funded, Only Limited Disaster Relief Included

When the new fiscal year commenced over the weekend, all federal departments and agencies remained funded and operational, thanks to a hastily enacted Continuing Resolution (H.R. 6833). The package maintains existing funding levels through mid-December when the lame-duck Congress must enact appropriations to run through September or pass another short-term measure. The new law also provides $12.3 billion in economic and military support for Ukraine, and some natural disaster financial aid, including $2.5 billion in funding for New Mexico to recover from the Hermit’s Peak/Calf Canyon fire in April, $2 billion in additional disaster aid; $20 million for water infrastructure in Jackson, Mississippi, and instructions for the federal government to fully cover typhoon assistance in Alaska.

Beyond this relief, policymakers, including Florida Senators Rubio and Scott, have expressed growing interest in providing more substantial support in response to Hurricanes Fiona and Ian. Any such relief, however, would likely have to wait until after the elections. Charitable nonprofits directly impacted by disasters themselves, providing relief services to others, and helping their communities recover need to advocate now for natural disaster tax relief. Contact your U.S. Representative and two Senators today and demand that Congress restore expired tax provisions that will enable organizations to be there when their fellow residents need them most.

Now, While They Are Paying Attention:

Tell Federal Candidates to Restore Expired Tax Relief

Join the efforts of a national coalition of nonprofits in urging the President and congressional leaders to restore expired charitable giving incentives and the Employee Retention Tax Credit so nonprofits have much-needed resources to support relief and recovery efforts in their communities. Learn more at the Natural Disaster Tax Relief webpage.

Take Action: Tell your Senators and Representatives they must enact disaster relief legislation that restores and expands expired charitable giving and employment tax incentives before the next natural disaster hits.

- Email (Representatives, Senators) and tweet to your Representative and Senators the new nonprofit disaster-relief letter: https://bit.ly/3TD9l0G.

- Retweet messages from @NatlCouncilNPs and #Relief4Charities to your Representative and Senators.

Natural Disaster Resources:

Supreme Court Term Opens

Today, the first Monday in October, marks the beginning of the new term of the U.S. Supreme Court. During this 2022-23 term, the Court will consider several significant cases of interest to nonprofits. Race figures prominently in the Court’s agenda. Tomorrow the Court will hear arguments on whether Alabama’s redistricting plan violated the Voting Rights Act. Later this month, it will hear two cases regarding affirmative action and how race can be used in university admission practices. Other cases have implications on arts and culture (whether a derivative work of art is transformative for copyright law purposes), environmental policy (the authority of the EPA over wetlands), and labor and employment law (if highly compensated supervisors can earn overtime pay). Perhaps the biggest potential blockbuster, because it could shake democracy to its core, involves a case seeking to eliminate the ability of state courts to review state election laws under their states’ constitutions. The Court will continue providing live audio broadcasts of arguments, a practice instituted due to the pandemic, as well as reopen its doors to the public after two-and-a-half years of virtual or closed-door sessions.

Worth Reading

- As New Term Starts, Supreme Court Is Poised to Resume Rightward Push, Adam Liptak, The New York Times, Oct. 2, 2022.

- Supreme Court Term Opens With New Justice and Weighty Cases, Jess Bravin and Jan Wolfe, The Wall Street Journal, Oct. 2, 2022.

- You thought the Supreme Court’s last term was bad? Brace yourself., Ruth Marcus, The Washington Post, Sept. 30, 2022.

- Supreme Court Trust, Job Approval at Historical Lows., Jeffrey Jones, Gallup, Sept 29. 2022.

Student Loan Forgiveness Update

There are two separate programs designed to reduce the student loan burden, but confusion abounds because most news reports lump them into one story. The first program is the longstanding, formal Public Service Loan Forgiveness program that can provide relief to nonprofit employees and others in public service jobs. The second program – the debt cancellation plan – which has received the most attention because it’s available to almost everyone with federal student loans – would cancel up to $10,000 (or $20,000 for some people) of student loan debt.

PSLF Waiver to Expire - Check Your Status NOW!

The Public Service Loan Forgiveness (PSLF) Temporary Waiver ends Oct. 31, 2022, meaning individuals with federal student loans who work in public service jobs – which expressly includes charitable nonprofits -- only have until Halloween to submit their loan certification forms to determine whether more of your previous payments (late, early, lump sum, etc.) may count towards forgiveness. The formal PSLF, which has been around since 2007, has a Temporary Waiver that expires October 1, 2022. The Temporary Waiver significantly expands who's eligible. So even if you’ve been denied in the past, you now may be eligible, but only if you take immediate action. Check out the PSLF Help Tool now!

- Employees with Federal Student Loan Debt: check your eligibility for Public Service Loan Forgiveness today!

- CEOs and Executive Directors: tell your employees to check today!

- Everyone: spread the word!

Bottom Line: All charitable nonprofit workers with federal student debt should check your eligibility status for Public Service Loan Forgiveness under the Temporary Waiver by Oct. 31, which is separate from the debt cancellation plan. Do not miss out on this one-time opportunity to receive forgiveness on previously ineligible payments.

Retweet the image above, with links in the tweet nonprofit employees and employers can use.

Student Debt Cancellation

In August, President Biden announced a plan for student debt relief by cancelling up to $10,000 in federal student loans for most borrowers and $20,000 for Pell Grant recipients. To qualify, borrowers must have incomes of less than $125,000 for individuals or $250,000 for couples. The Administration stated applications for the cancellation are to be available beginning this month and will be open through December 2023. See A Nonprofit Perspective on Student Loan Relief for more information.

Cost Estimate: The plan is estimated to cost the Treasury $420 billion over 10 years, according to the nonpartisan Congressional Budget Office. The estimate does not, however, take into account new repayment caps or other changes to loan terms implemented this summer. The CBO states that the “estimates are highly uncertain” and will depend on projections on future economic conditions and modifications in loan terms.

Litigation: Six Republican state attorneys general filed suit to challenge the loan forgiveness program, arguing financial hardship to the private, for-profit loan servicers that hold and process federal loans (FFEL loans) will harm their state revenues. The suit further contends the debt relief violates the federal Administrative Procedures Act and that the pandemic emergency declaration basis for the plan is invalid now that the President has said the pandemic is over. The Administration responded by no longer permitting the consolidation of certain private loans to federal loans and excluding privately held debt from the relief. More lawsuits are expected although legal experts differ on whether the cases will be permitted.

Federal FastView

- Public Support for Giving Incentives: Nearly six in seven (85%) voters support restoring the universal or nonitemizer charitable deduction permanently for all taxpayers, while over three-quarters (77%) support expanding the deduction to up to $4,000 for all Americans, according to public opinion polling released by Independent Sector. The nonitemizer deduction of $300 for individuals and $600 for couples claiming the standard deduction on their tax forms expired at the end of 2021. Legislation has been introduced (S. 618/H.R. 1704) to restore and improve the universal charitable deduction.

- Ending Hunger by 2030: On September 28, the White House convened the Conference on Hunger, Nutrition, and Health where it announced a strategy to end hunger and reduce diet-related diseases by 2030. The campaign includes $8 billion in commitments and lists partnerships with universities, philanthropy, and nonprofits. The YMCA committed to serving more than 140 million meals to children in need and deliver sports programming to 6 million youth by 2030. Ellie Hollander, President and CEO of Meals on Wheels America, stated that with “thousands of Meals on Wheels programs reaching nearly every community in America, we have the infrastructure to help solve the issues of senior hunger and social isolation, which not only jeopardize the health and well-being of older adults, but also place a significant strain on our country’s healthcare system and economy.”

- Arts/Humanities Commission Restored: President Biden on Friday issued an executive order declaring that “the arts, the humanities, and museum and library services are essential to the well-being, health, vitality, and democracy of our Nation.” He re-established the President’s Committee on the Arts and the Humanities, an advisory board dissolved by then-President Trump. The group’s role is to “inform and support the national engagement with Americans necessary to advance the arts, the humanities, and museum and library services.”

- Think Tank Transparency: Senator Chuck Grassley (R-IA) and Representative Jack Bergman (R-MI) introduced the Think Tank Transparency Act (S.4987/H.R.8996) to mandate transparency from 501(c)(3) and 501(c)(4) organizations receiving donations from foreign principals, defined as foreign governments, persons, or entities. The legislation would require nonprofits and social welfare organizations to disclose to the public funds in excess of $10,000 provided by foreign principals. It would also require that organizations would have to identify the foreign principal when providing briefings, testimony, research, and similar communications with Congress or the Executive branch. See Senator Grassley’s news release.

- PPP Loans to Nonprofits: A report from the SBA Inspector General last week expresses the belief that 179 Paycheck Protection Program (PPP) loans, totaling approximately $684 million, were “made to potentially ineligible nonprofits that may have exceeded SBA’s requirements for business size, known as size standards, at the time of application.” Among the nonprofits targeted for investigation, the report found that Planned Parenthood of Illinois was legally eligible for the loan it received for over $3.8 million, while the appropriateness of loans to other organizations depended on timing of when they sought loan forgiveness. If the Inspector General is correct in questioning 179 loans, that total would amount to 0.1 percent of the charitable nonprofits that received PPP loans, and only 1.36% of the $50 billion in PPP loans made to charitable nonprofits.

Worth Reading

- The $800 Billion Paycheck Protection Program: Where Did the Money Go and Why Did It Go There?, David Autor, Journal of Economic Perspectives, January 2022.

- Who Benefited from the Paycheck Protection Program?, Steve Dubb, Nonprofit Quarterly, Sept. 28, 2022.

Worth Listening

- How Philanthropy Should Respond to Natural Disasters (30:00), Center for Effective Philanthropy’s Giving Done Right podcast, Sept. 29, 2022, featuring an interview with Patty McIlreavy, president and CEO of the Center for Disaster Philanthropy, who addressed philanthropy’s responsibility for prevention and recovery, the most common pitfalls for donors responding to disasters, and both successful and unsuccessful examples of giving in the aftermath of natural disasters, plus issues of equity in disaster prevention and response.

Promoting Democracy

Make a Statement: Give Your Nonprofit's Staff Time Off to Vote

One of the easiest ways nonprofits can help promote elections is by giving their staff paid time off to vote during Early Voting or on Election Day. To help nonprofits show leadership when it comes to empowering the millions who work daily to improve their communities, Nonprofit VOTE, the National Council of Nonprofits, and several other national organizations launched the Nonprofit Staff Vote campaign. We encourage your nonprofit to join also.

Be an Informed Voter

Resources are readily available for accurate, nonpartisan information voters need to register and cast their ballots. Here are a few excellent sites:

- State Elections 2022, National Conference of State Legislatures, providing analysis of voting, ballot measures, and election administration.

- Vote 411, League of Women Voters website where you can register to vote, find your polling place, look up your ballot, and more.

- Voting in Your State, Nonprofit VOTE, connecting you with state nonprofit organizations and official voting information directly from your state’s elections website.

Worth Quoting

- “Given the role local nonprofits have played on the front lines of pandemic response - distributing food to homebound seniors, providing childcare for essential workers, strengthening families through mental health services and door-to-door wellness checks, and vaccinating thousands of vulnerable residents - we are surprised that multiple San Jose candidates for elected office have disparaged the value of nonprofit sector work."

— Michele Lew and Alison Brunner, writing in Stop the political attacks on Silicon Valley nonprofits, San Jose Spotlight, Sept. 23, 2022.

- “Roads towards meaningful, community-centered change all lead to the ballot box, and community-based nonprofits have played relatively silent, but significant roles in ensuring people most often marginalized can use their power and voices and participate in our democratic process.”

— Nonoko Sato, Executive Director of the Minnesota Council of Nonprofits, writing in Nonprofits as Agents of Democracy, National Committee for Responsible Philanthropy, Aug. 1, 2022, answering important questions about why and how charitable nonprofits promote democracy, and offering advice on what philanthropy can do to help.

Worth Reading

- Politics ain’t beanbag. It isn’t philanthropy, either., Charles Lane, The Washington Post, Sept. 28, 2022.

Worth Listening

- A Nonprofit Leader Discusses How to Spark Change Through Service and Advocacy (39:12), Giving Gone Right podcast, The Chronicle of Philanthropy, Sept. 23, 2022, featuring Silvia Vargas, leader of Boston-area nonprofit La Colaborativa, which provides social services and programs to Latinx immigrants, talks about how nonprofits can advance their missions through both direct service and advocacy.

Trend Spotting: 2022 Ballot Measures

There are 130 measures on the November 8 ballots that include issues that state legislatures have referred to voters (legislative referendums) and citizens have directly put of the ballot for voters to decide (initiatives) on issues like health, labor, education, and taxes. For instance, Proposition FF in Colorado would lower the cap for itemized and standard deductions (including charitable giving incentives) certain taxpayers can claim, and the state would use the $100 million in increased taxes to create a free school meals program for students in public schools. A measure in Georgia would allow temporary property tax changes for areas impacted by natural disasters. Voters in Nebraska, Nevada, and the District of Columbia will decide whether to increase the minimum wage. Three states – Arkansas, Idaho, and Kentucky – could empower legislators to convene special sessions without a call from the governor. A North Dakota ballot measure would establish term limits for state legislators and governors. See more ballot measures of interest to nonprofits on our 2022 ballot measures page.

Note: For charitable nonprofits, advocating for or against ballot measures is considered allowable legislative lobbying, and not the forbidden partisan activities for or against candidates running for public office. Charitable nonprofits can take a position on a ballot measure and engage in activities such as organizing volunteers to support (or oppose) a position, though these are subject to the limits on lobbying. Nonprofit VOTE.

ARPA Investments in Nonprofits

Last week, the San Antonio, Texas, City Council allocated $5 million in ARPA funds to be distributed to 46 local art nonprofits, such as museums and education groups, and 136 artists who experienced disproportionate impact from COVID-19. According to the city, the nonprofits reported $47 million worth of losses while artists suffered $3.5 million in losses. The grants will go towards funding existing programs and supporting living expenses. Richland County, South Carolina, announced it will distribute $4 million to local organizations involved in affordable housing, and $2 million to nonprofits that address food insecurity, offer broadband services, and provide services to unhoused people. Charles County, Maryland, will distribute $500,000 to nonprofits to continue responding to the negative impact of the pandemic and funds may include reimbursable expenses. The Oklahoma Legislature approved $1.4 billion in ARPA funds as part of an appropriations bill, including $549.8 million for broadband expansion and $10 million for the Oklahoma Arts Council to help nonprofits impacted by the pandemic. However, it failed to advance recommendations from a special committee that called for spending nearly $100 million in ARPA funds to expand child care access, eliminate food deserts, improve domestic violence services and reduce child abuse.

Tracking ARPA Spending

Nationwide: ARPA Spending, National Council of Nonprofits, updated regularly.

State & Local: State and Local Fiscal Recovery Fund interactive dashboard, Pandemic Response Accountability Committee, updated regularly.

State: ARPA State Fiscal Recovery Fund Allocations, National Conference of State Legislatures, updated regularly.

Local: Local Government ARPA Investment Tracker, Brookings Institute, updated regularly.

Worth Quoting

- “We’re not offering them a handout. We’re offering them a hand up so that they can continue what they’ve been doing.”

— Councilman John Courage, quoted in City gives artists, art nonprofits $5m in federal relief money, Garret Brnger, KSAT, Sep. 29, 2022, on the 9-1 vote the San Antonio City Council to approve a spending framework to support the arts industry.

Worth Reading

- Oklahoma nonprofits alliance shows we are better together, Marnie Taylor, President and CEO of Oklahoma Center for Nonprofits, The Oklahoman, Oct. 2, 2022.

- How States Can Best Use Federal Fiscal Recovery Funds: Lessons From State Choices So Far, Ed Lazere and Iris Hinh, Center for Budget and Policy Priorities, Sept. 15, 2022.

Using ARPA Funds to Strengthen the Community Health Workforce

On September 30, the White House announced that $225 million in American Rescue Plan Act funds will be used to train over 13,000 Community Health Workers, building on investments several states have made with their State and Local Fiscal Recovery Fund allocations. The new Public Health AmeriCorps partnerships announced by the Administration will place up to 3,000 members in states like Georgia, Kentucky, and Texas to provide healthcare support in facilities, increase awareness of COVID-19 testing and vaccination, and increase access to healthcare. An estimated $100 million in ARPA funds is dedicated to train graduate students for placements in “community-based settings” where behavioral needs are most urgently needed. Addressing the same challenge, Chicago, Illinois, hired more than 800 health workers to build their healthcare training and support needs in their communities. San Diego County, California, hired over 250 community health workers to provide education in 26 languages to under-immunized populations, including refugee and Asian and Pacific Islander communities.

Workforce Shortages and Consequences

Recent data suggests that employment, especially for working-age women, has recovered to pre-pandemic levels, although some challenges remain. For instance, some industries still have not recovered lost employees, and there are 74,000 fewer child care workers available. United Teachers Los Angeles, in its “Burned Out, Priced Out” report, found that the pool of teachers is shrinking. The factors driving the shortage and solutions proposed in the report share similarities with the nonprofit workforce shortage crisis, namely that investments in closing the wage gaps can address inequities and prevent more employees from leaving altogether. These challenges go beyond the U.S. borders. A 2022 Community Assessment by a nonprofit in Ottawa, Canada, found that nearly 30 percent of nonprofit leaders said they plan to leave their positions in the next three years, up significantly from the pre-COVID era's 17 percent. Three out of four respondents (74%) reported a significant increase in demand for programs and services compared to the previous year.

Worth Quoting

- “If a restaurant is unable to find enough workers, it may be able to eliminate lunch service or cut back on slow afternoon hours. But if a nonprofit is forced to reduce services, it could be a life or death situation. Closures and service reductions of domestic violence shelters, food pantries, and services for the elderly mean that those in need will have to go without support.”

— Mary Alice Scott, Public Affairs Manager for the Maine Association of Nonprofits, writing in Businesses and nonprofits need to work together — the stakes are high, Mainebiz, Sept. 26, 2022.

- “Government contracts need to cover the full cost of delivering crucial services, just as they do when the contractor is a for-profit business. This commitment will deliver exponential benefits for communities - high-quality services across all aspects of nonprofit work, such as great job training, quality childcare, economic development, arts and cultural offerings, education, healthcare, housing, and more. These services improve the quality of life for all residents of Washington State, and we all deserve a bright future with flourishing communities.”

— Laura Pierce, Executive Director of the Nonprofit Association of Washington, writing in The Workforce Crisis is Real for Nonprofits, Puget Sound Business Journal, Sept. 16, 2022.

Numbers in the News

130

The number of ballot measures that address a wide range of issues, including health, labor, education, infrastructure, election, and taxes.

Source: Statewide Ballot Measures Database, National Conference of State Legislatures, updated Aug. 22, 2022.

October is

- AIDS Awareness Month

- LGBTQ+ History Month

- National Hispanic Heritage Month (Sept. 15-Oct. 15)

- National Arts & Humanities Month

- National Breast Cancer Awareness Month

- National Cybersecurity Awareness Month

- National Disability Employment Awareness Month

- National Domestic Violence Awareness and Prevention Month

Upcoming Events

- Oct. 6-7, Virtual HANOCON 2022, Hawaiʻi Alliance of Nonprofit Organizations

- Oct. 11, Nonprofit Candidate Forum, Nonprofit Association of the Midlands (NE)

- Oct. 13, Advocacy in Action, The Foraker Group

- Oct. 13, Advocacy and Lobbying for Nonprofits, Montana Nonprofit Association

- Oct. 13-14, MCN Annual Conference, Minnesota Council of Nonprofits

- Oct. 14, Elections Primer for Nonprofits, North Carolina Center for Nonprofits

- Oct. 18-20, 30th Anniversary Conference, Maryland Nonprofits

- Oct. 18-20, PANO Conferences, Pennsylvania Association of Nonprofit Organizations

- Oct. 19, MNN Conference, Massachusetts Nonprofit Network

- Oct. 20, Nonprofit Advocacy: Why Nonprofits and Why Now?, Nonprofit Association of Oregon

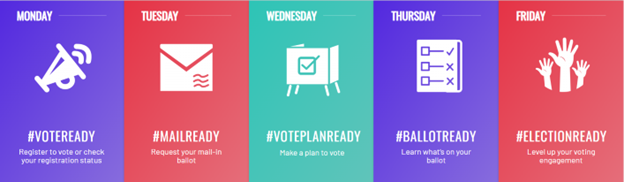

Welcome to National Voter Education Week!

Oct 3-7, 2022

National Voter Education Week is a campaign to help voters bridge the gap between registering to vote and actually casting a ballot. During this week of interactive education, voters have the opportunity to find their polling location, understand their ballot, make a plan to vote in person or remotely, inspire others to get involved, and more. The goal of this week of education and action will build voter confidence and empower people to become ambassadors of voting in their own communities. Learn more.

On Earning & Keeping Trust, Nonprofits' Greatest Asset

Regular readers of this newsletter are well aware that public policy challenges can undermine the work of charitable organizations. That’s one reason, out of many, nonprofits need to be transparent and operate ethically. Any action that breaches the public’s trust can hurt all 501(c)(3) if lawmakers then push bills that burden charitable operations, impose unrealistic expectations, or apply discriminatory treatment.

With these points in mind, now is a good time for a refresher course on why nonprofit law and oversight are essential – to promote trust.

Continue reading "On Earning & Keeping Trust, Nonprofits' Greatest Asset"