Are Nonprofit Workforce Shortages Still a Problem?

Is your charitable nonprofit struggling with unfilled vacancies, long waiting lists of people seeking services, chronic burnout, and other challenges? Or is the nonprofit workforce shortages crisis a thing of the past? The entire charitable sector needs to know.

A major survey and report in late 2021 identified the scope of the problems related to nonprofit workforce shortages and identified public policies and practical solutions that have helped organizations hire and retain the staff they need to advance their missions. We invite you to complete the updated survey and help the nonprofit sector tell its story.

Take the Survey

Preparing for the End of Pandemic Emergency Declarations

The end of the national and public health emergency declarations are still more than a month away – on May 11 – but the impacts on individuals and the nonprofits serving them are becoming clearer. As previously reported, supplemental food supports ended in February, causing a spike in the number of people turning to food banks, houses of worship, and other charitable organizations to meet their needs. This past weekend, expanded Medicaid eligibility ended in five states – Arizona, Arkansas, Idaho, New Hampshire, and South Dakota – to be followed by 14 more states in May and 20 additional states plus the District of Columbia in June. To help raise awareness of more changes coming, the Administration for Children and Families (ACF) at the Department of Health and Human Services published information on the affected programs and resources on preparing for the end of the COVID-19 Public Health Emergency on May 11. Affected programs include the Child Care and Development Fund (CCF), Head Start, and Tribal and State child support.

Worth Reading

- As pandemic benefits wind down, a reckoning for households and economy, Abha Bhattarai, Washington Post, Apr. 2, 2023.

- ‘Catastrophe’ for Poor New Yorkers as Pandemic Food Aid Ends, Emma G. Fitzsimmons, New York Times, Mar. 27, 2023

- The pandemic has eased. The food insecurity it caused has not., editorial, Charleston (SC) Post and Courier, Mar. 23, 2023.

IRS Dirty Dozen and Tax Scams Targeting Nonprofits

The Internal Revenue Service is out with its annual Dirty Dozen list of tax scams and two items are warnings to charitable nonprofits and the people who support them:

- ERTC Claims: New to the Dirty Dozen this year is the IRS spotlight on aggressive marketing schemes by promoters to con ineligible businesses and nonprofits to claim the Employee Retention Tax Credits (ERTC). “While the credit has provided a financial lifeline to millions” of employers, said IRS Commissioner Danny Werfel, “there are promoters misleading people and businesses into thinking they can claim these credits.” The IRS is increasing scrutiny on what it calls “aggressive promoters making offers too good to be true.” (IR-2023-49, Mar. 20, 2023) Learn more about ERTC eligibility for charitable nonprofits.

- Fake Charities Scams: Perennially on the Dirty Dozen list, the IRS urges everyone to be on alert for scammers using fake charities to dupe taxpayers, especially following major disasters, to turn over money and identity-related information. The IRS advises people not to give in to pressure tactics from scammers, to verify any organization before contributing, to be wary about how a donation is requested – requests for gift cards or wiring of money are red flags – and to not give more than needed. Bottom line: individuals “should never give out Social Security numbers, credit card numbers or PIN numbers, and they should give bank or credit card numbers only after they've confirmed the charity is real.” (IR-2023-57, Mar. 24, 2023)

Worth Studying

- Exempt Organizations Technical Guide: Exempt Purpose, Charitable – IRC 501(c)(3), Internal Revenue Service, Mar. 20, 2023.

FastView

- Update on the Charitable Act: Support in the Senate continues to grow for the Charitable Act (S.566), the legislation by Senators Lankford (R-OK) and Coons (D-DE) that would ensure all taxpayers have a tax incentive for giving to the work of charitable nonprofits. Specifically, the bill would enable taxpayers who take the standard deduction (about 88% of taxpayers) to deduct charitable donations of up to one-third of the standard deduction, or about $4,600 for individuals and $9,200 for married couples based on the current standard deduction. The bill now enjoys the bipartisan support of 14 Senators, seven Democrats and seven Republicans (alpha by state): Boozman (R-AR), Coons (D-DE), Rubio (R-FL), Warnock (D-GA), Collins (R-ME), Peters (D-MI), Klobuchar (D-MN), Wicker (R-MS), Cortez Masto (D-NV), Hassan (D-NH), Shaheen (D-NH), Lankford (R-OK), Scott (R-SC), and Blackburn (R-TN). The legislation will likely be introduced in the House after the April recess. See the letter of endorsement from the networks of the National Council of Nonprofits.

- Race and Ethnicity Statistical Standards and Data Collection: The federal Office of Management and Budget (OMB) recently announced proposed changes to language and standards regarding race and ethnicity data collection for all federal agencies, including the U.S. Census. The request for comments relates to updating OMB Statistical Policy Directive No. 15 that determines “the minimum set of categories that all Federal agencies must use if they intend to collect information on race and ethnicity.” OMB is seeking comments from the public on two key changes: (1) whether to combine race and ethnicity into one question for Hispanic and Latino/Latina, and (2) whether to add a Middle Eastern or North African (MENA) category. A recent paper from the Brookings Institution expressed support for these changes, but complained that “they don’t improve data representation for a group that has long been misrepresented: American Indians and Alaska Natives (here collectively referred to as ‘Native Americans’).” Public comments are due April 12. Submit comments on the Federal Register form.

-

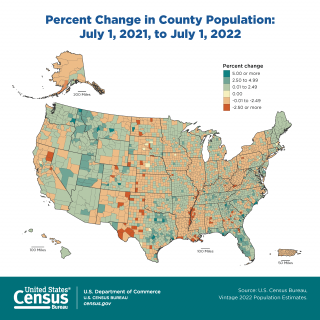

New Census Data on County Populations: The U.S. Census Bureau released its Vintage 2022 estimates on March 30, showing population growth and decline in 3,144 counties in the country. According to their estimates, more than half of all counties (52.5%) grew between 2021 and 2022, while 47.1% declined. Counties with populations below 10,000 experienced more population loss, while counties with populations greater than 100,000 mainly experienced increases. The 10 fastest-growing counties were all located in the South or West. Components of population change included domestic migration, international migration, and natural decrease (more deaths than births) and increase (births exceeding deaths).

- Better Data for Better Planning: A longstanding data challenge for nonprofits is gaining enough congressional awareness to enact solutions. Charitable nonprofit employment data usually is a matter of conjecture because the federal Bureau of Labor Statistics (BLS) only releases nonprofit jobs information every five years. For-profit and government employment data, on the other hand, are reported on a quarterly basis, enabling those sectors to identify hiring and layoff trends, gauge employment and pay patterns, and plan for the future. A large coalition of nonprofits and researchers has been calling on the federal government to “release accurate and accessible data on nonprofit employment and wage trends on a quarterly basis, on par with other major industries in the country.” An effort is underway in the Senate through the appropriations process to secure legislative language and resources to enable the BLS to provide nonprofits parity in access to vital employment data. Nonprofits are asking their Senators to submit a program request for an additional $5 million to be allocated to BLS' Office of Employment and Unemployment Statistics to incorporate nonprofit data into the Quarterly Census of Employment and Wages.

Taking Advantage of the Passover/Easter Recess

Members of Congress will be out of Washington, DC on recess for the next two weeks for Passover and Easter, giving charitable nonprofits the ideal opportunity to meet with elected federal officials back home. The highest priority is to urge officials to raise the federal debt limit to avert a default that would push the US into an unprecedented economic crisis. Senators and Representatives need to hear directly from nonprofit professionals about how a default and related shutdown of the federal government would hurt the lives and wellbeing of the people charitable organizations serve. Experiences during past government shutdowns, such as the unfunded mandates that nonprofits suddenly take care of tens of millions more individuals, should serve as a guide.

Many other policy priorities need urgent congressional action as well, ranging from restoring and expanding expired charitable giving incentives and addressing nonprofit workforce shortages, to improving child care access and funding essential programs. On May 11, the national and health emergency declarations related to the COVID-19 pandemic expire, thereby ending expanded enrollment in Medicaid, housing support programs, and numerous other forms of relief. Nonprofits have the opportunity and need over the two-week recess to alert Members of Congress to how the looming loss of these programs will hurt individuals in the community and impose more burdens on nonprofits.

Overcoming Barriers to Invest ARPA Funds in Nonprofits

While state and local governments have until December 31, 2024, to obligate, or indicate how they will spend their share of the $350 billion Coronavirus State and Local Fiscal Recovery Funds, governments continue to make progress and invest in charitable nonprofits. Last year, Michigan created a Nonprofit Relief Fund using the state’s ARPA funds that is managed by the Michigan Nonprofit Association. Last month, the $35 million MI Nonprofit Relief Fund opened the application process for nonprofits with annual revenues of less than $1 million that experienced losses due to the pandemic: small nonprofits could receive funds ranging from $5,000 to $25,000. A separate $15 million grant for larger nonprofits will be administered and launched by the Department of Labor and Economic Opportunity later this spring.

Some governments have delayed announcements or plans for ARPA spending out of uncertainty around eligible uses of funds. The City Council in Gary, Indiana, recently agreed to appropriate $800,000 in ARPA funds for nonprofits and a committee will review applications later this year. The City’s Director of Community Development cited the Treasury Final Rule to assure Council members that funds can be used to provide assistance to nonprofits. In Mississippi, a bill awaiting the Governor’s signature would allow the Lowndes County Board of Supervisors to allocate part of the county’s $11 million in ARPA funds to local nonprofits. The county had to get legislative approval given that the state auditor’s office stated the funds can’t be spent “any differently from what you would normally spend money on.”

As communities develop funding plans, governments and nonprofits can refer to guiding principles for high-impact programs, and recommendations for designing and managing programs that allow more nonprofits to contribute to recovery efforts around the country.

Government Grants and Contracting Reforms in the States

The pandemic exacerbated numerous, long-standing challenges caused by flaws in government grants and contracting processes, and lawmakers around the country are taking action to provide remedies.

- Lawmakers in California recently introduced a package of seven bills as part of the California Nonprofit Equity Initiative. The individual bills would have the state making some payments for contracted services up-front, providing flexibility during emergencies, streamlining small grant programs, extending requirements to pay nonprofits promptly, and covering indirect costs, among other things. See the CalNonprofits summary for more bill information.

- A Kentucky bill awaiting the Governor’s signature would establish the Government Resources Accelerating Needed Transformation (GRANT) program to streamline the grantmaking process through, among other things, creating standardized grant applications and establishing the GRANT fund to pool funding and award matching fund grants to GRANT program recipients and to match federal grants.

- North Carolina’s FY 2023-25 budget includes important reforms for government-nonprofit grants and contracts. One would require state agencies to make prompt payments to nonprofits receiving direct grants. Another provision would permit advance payments to nonprofits rather than after-the-service reimbursement.

- See reports about reforms in Maryland, Massachusetts, New York City, and Oregon in Nonprofit Champion, Feb. 6, 2023 edition.

Worth Watching

- Brooklyn nonprofit that has provided incarceration alternatives to thousands feeling pinch of NYC's bureaucracy (00:02:41), CBS New York, Mar. 20, 2023, chronicling the impact of late payments from the city on charitable nonprofits providing services on the city’s behalf.

Worth Reading

- One State’s Grant Management Breakthrough, Stephanie Kanowitz, Route Fifty, March 16, 2023.

States Seeking to Address Child Care Shortages

Lack of access to affordable child care remains one of the top concerns for employers, including charitable nonprofits, and employees across the countries. State lawmakers are actively working to reduce burdens, estimated at $122 billion per year in lost earnings, productivity, and revenue, through grants, tax credits, salary supplements, and incentives. States are paying for some of these policy changes by tapping an estimated $52 billion in federal pandemic child care aid available to states and localities, most of which must be spent by Sept. 30 this year.

- Governors in Maine, Missouri, and Ohio have all proposed funding in their budgets to increase child care access.

- Legislation in Montana would establish the Best Beginnings Child Care Scholarship Program for low-income families.

- A measure in Nebraska would extend the sunset date for transitional child care assistance to 2026.

- Lawmakers in North Carolina have introduced bills to create a private partnership between the state and the North Carolina Partnership for Children to improve access to high quality childcare for working families. Separate legislation would increase the child care subsidy rate.

- Finally, legislation in Maine would require large employers to provide on-site childcare; however, advocates are pushing for easier access and less regulations on child care centers to ease the burden for working parents.

Taxes, Fees, PILOTs

Nonprofit Property Tax Exemptions Under Attack, Again

Normally, local elected officials only turn against their trusted and valued charitable nonprofit partners to extract money in times of extreme financial distress, such as recessions or the loss of a major employer. Not so now when most states, and even cities, are reporting record tax revenues and surplus funds. A string of actions by a few officials appear to be emboldening others to look to tax-exempt organizations as an as-yet untapped funding source.

A judge in Pennsylvania recently revoked a nonprofit hospital’s property tax exemption and denied appeals regarding three others, an action that one expert said serves as a “warning shot” for nonprofit facilities throughout the Commonwealth. The compensation paid to some hospital executives was one reason the judge ruled against the tax exemption. Also in Pennsylvania, Pittsburgh’s mayor announced last month he will challenge the tax-exempt status of 26 Pittsburgh properties, as part of a review process he ordered in January. The mayor had run on a platform of making one particular nonprofit – UPMC hospital system – pay “its fair share.”

The notion of taking money away from tax-exempt nonprofits’ missions to fill local governments’ coffers appears to be spreading. The City Council in Holyoke, Massachusetts reportedly is questioning whether charitable nonprofits owning property in the city are paying their “fair share.” In Rhode Island, an op-ed in Sunday’s Providence Monthly is calling on that city’s new mayor to renegotiate payments in lieu of taxes (PILOT) programs with local nonprofit landowners like Brown University and the Rhode Island School of Design. The article accuses prior mayors of being out-negotiated by nonprofits while only partially acknowledging the immense economic benefit and impact the organizations provide to their communities.

Worth Reading

- Gainey lines up tax-exempt challenges, including bid to tax some UPMC-owned properties, Charlie Wolfson, Public Source, Mar. 28, 2023.

- Nonprofit hospitals save more in tax exemptions than they provide in charity care, Arielle Dreher, Axios, Mar. 15, 2023.

- Hospitals and Health Systems More than Earn their Tax Exemption, Rick Pollack, President and CEO of the American Hospital Association, Mar. 16, 2023.

Worth Listening

- Public Policy Is Your Friend, I Was Told There Would Be Snacks: A Nonprofit Podcast, presented by Momentum Nonprofit Partners of Memphis, Tennessee, Mar. 28, 2023, explaining what nonprofits can do on public policy and advocacy to advance their missions; featuring David L. Thompson and Jessica Mendieta of the National Council of Nonprofits.

Numbers in the News

27%

Share of the public that believe “community involvement” is very important to them, plummeting from 62% in 2019. In the poll, comparing attitudes in 1998 to today, people also showed declining support for patriotism (70% down to 38%) and religion (62% down to 39%). Those responding that money is very important has risen from 31% to 41% over the past 25 years of the survey.

Source: WSJ/NORC Poll March 2023. See also, America Pulls Back From Values That Once Defined It, WSJ-NORC Poll Finds, Aaron Zitner, Wall Street Journal, Mar. 27, 2023.

April is

- National Child Abuse Prevention Month

- National Fair Housing Month

- National Financial Literacy Month

- National Volunteer Month

Nonprofit Events

- Apr. 3-4, Oregon Nonprofit Leaders Conference, Nonprofit Association of Oregon

- Apr. 18, Advocacy and Lobbying for NY Nonprofits, Nonprofit New York

- Apr. 20, IMPACT Delaware Conference, Delaware Alliance for Nonprofit Advancement

- Apr. 20, Midsouth Nonprofit Conference, Momentum Nonprofit Partners (Memphis, TN)

- Apr. 20, It’s Time to Advocate: Tips, Center for Nonprofit Excellence (Charlottesville, VA)

- Apr. 25, Nonprofit Advocacy Day, Oklahoma Center for Nonprofits

- May 11-12, Leadership Summit, The Foraker Group (Alaska)

- May 16, Annual Caring Force State House Rally, Providers’ Council

A Survey’s Journey From Responses to Results

What if you filled out a survey and could trace your responses to actual changes in public policy that improve community wellbeing? That’s the aim of the current Nonprofit Workforce Survey that nonprofit organizations are asked to complete in April 2023. That goal is based not on hope alone, but on the positive results flowing from the 1,000+ nonprofits responding to the previous nonprofit workforce survey conducted in the fall of 2021. If past is truly prologue – and ample numbers of nonprofits complete the survey – then public policy advocacy, media attention, and meaningful results will follow.