Federal and state laws give nonprofits the option of operating as self-insured (“reimbursing”) employers that make payments to their state unemployment insurance systems for benefits attributable to them in lieu of advance contributions. Shutdown orders by government officials and program cancellations during the COVID-19 pandemic forced nonprofits to furlough or layoff staff, triggering immediate, catastrophic unemployment payment bills. The costs diverted valuable funds from mission services and forcing additional layoffs.

Why It Matters

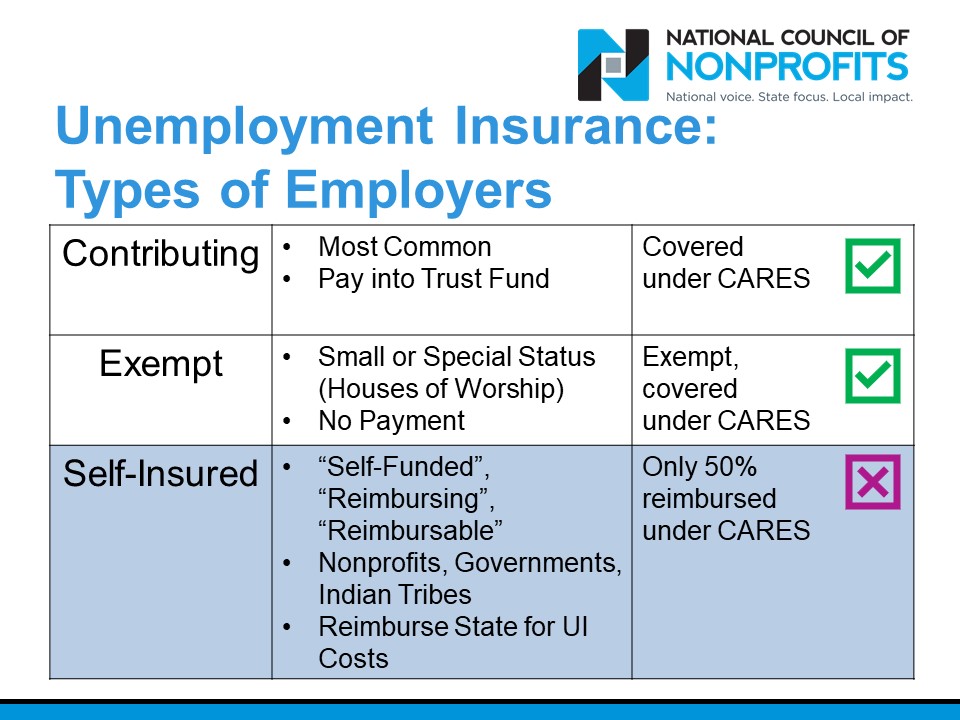

During the pandemic, all employers and employees experienced a crisis that the unemployment system was never created to handle. Through the CARES Act, and expanded by the American Rescue Plan Act, Congress took steps to protect both employees and employers by ensuring that workers who lost their jobs due to the pandemic got the unemployment assistance they need. Most employers – those that contribute taxes to the state unemployment system –experienced little or no additional costs resulting from mass COVID-19-related layoffs thanks to federal action.

Self-insured (also known as “reimbursing”) employers, however, suffered the immediate and costly application of a policy that they pay 50% of the costs of benefits paid to employees they were forced to lay off or furlough due to the pandemic.

Where We Stand

"We urge Congress to increase the federal unemployment insurance reimbursement for self-insured (reimbursing) nonprofits to 100% of costs."

- Urgent Nonprofit Policy Priorities in Reforms to CARES Act, Community Letter, July 13, 2020

Status

The American Rescue Plan Act, passed March 2021, increased from 50% to 75% the federal coverage of the unemployment costs of reimbursing nonprofits temporarily and provided continued coverage for self-employed workers and staff of religious and very small nonprofits. States are permitted to use federal monies for unemployment insurance costs, including shoring up the state’s unemployment trust fund and repaying loans from the Federal Unemployment Account.

Officials in twenty states (Delaware, Georgia, Hawaii, Iowa, Illinois, Kentucky, Louisiana, Maryland, Massachusetts, Michigan, Minnesota, Montana, Nebraska, New Hampshire, New Jersey, New Mexico, New York, North Carolina, North Dakota, Ohio, and Pennsylvania) worked to ease the burden on reimbursing nonprofit and other employers.

Some states (Alabama, Arizona, Iowa, Louisiana, Maryland, and New Mexico) also allocated millions of dollars to their state unemployment trust funds to bring them up to pre-pandemic levels and avoid automatic tax increases on contributing employers.

More About Unemployment Insurance

- Don’t Let Senseless Unemployment Policies Sink Nonprofits—Act Now!, Nonprofit Quarterly, May 8, 2020.

- Self-Insured Nonprofits and Unemployment Insurance, David Heinen, National Council of Nonprofits, Mar. 23, 2020.

- Statement to the Senate Finance Committee on Nonprofits and Unemployment Insurance, National Council of Nonprofits, June 9, 2020.

Additional Resources

- Coronavirus State & Local Fiscal Recovery Funds: Overview of the Final Rule, Department of the Treasury, January 2022, page 18.

- Statement Regarding Compliance with the Coronavirus State and Local Fiscal Recovery Funds Interim Final Rule and Final Rule, Department of the Treasury, Jan. 2022, page 3.