Positive Overhaul of Federal Grants Guidance Announced

Last week, the federal Office of Management and Budget (OMB) released its major rewrite of the Uniform Guidance, the set of common rules governing most federal grantmaking to charitable nonprofits, state, local, and Tribal governments, and others. The reforms correct longstanding challenges in the government grants process that have limited nonprofit effectiveness, discouraged qualified organizations from seeking and performing under federal grants, and wasted billions of dollars and countless hours in needlessly complex application and reporting requirements. Of particular note, the revised Guidance raises the de minimis indirect cost rate that governments using federal funds must pay to every grantee 15% (up from 10%), removes multiple barriers to accessing federal grant funding, mandates streamlining and simplifying of Notices of Funding Opportunities (requests for proposals), raises the Single Audit threshold to $1 million, and more. The changes go into effect on October 1, 2024. This new resources from the National Council of Nonprofits, OMB Uniform Guidance Final Rule, highlights the key provisions affecting charitable nonprofits working with governments at all levels.

Grants Reform Focus: Equity from the Outset

The newly released reforms to the OMB Uniform Guidance embrace equity from the outset. As stated by the Administration from the beginning of its grants reform rulemaking, “unnecessary complexity means that often the recipients most in need of Federal financial assistance cannot access it.” This includes “those who may be most well suited to serve the populations many Federal programs are designed to serve.” The new rules seek to overcome these barriers in numerous ways. The exclusive use of English language in notices, applications, and reporting will no longer be required, thus providing access to many more organizations and communities. OMB clarifies that a federal agency should consider diversity when developing policies and procedures for merit review panels and encourages federal agencies to develop programs in consultation with the communities that will benefit from or be impacted by a program. Perhaps most clearly, the reforms to simplify and clarify Notices of Funding Opportunities have been expressly designed, according to OMB, “in consideration of applicants with less experience applying for federal financial assistance, such as applicants from underserved communities.”

Worth Studying

- Grants for Federal Financial Assistance (Uniform Guidance), Office of Management and Budget, Apr. 4, 2024.

- The Biden-Harris Administration Finalizes Guidance to Make Grants More Accessible and Transparent for Families, Communities, and Small Businesses, White House news release, Apr. 4, 2024.

- OMB Uniform Guidance Final Rule, National Council of Nonprofits, Apr. 4, 2024.

Federal FastView

- Bipartisan Data Privacy Bill Unveiled: Over the weekend, chairs of the House and Senate Commerce committees announced bipartisan legislation to pre-empt state laws and create a national data privacy standard. The American Privacy Rights Act would require covered entities to be transparent about how they use consumer data and give consumers the right to access, correct, delete, and export their data, as well as opt out of targeted advertising and data transfers. The legislation would expressly exempt small businesses, including charitable nonprofits, with annual gross revenues of $40 million or less that do not annually collect data from more than 200,000 individuals and do not sell covered data to third parties. See bill summary.

- Federal Race, Ethnicity Data Reporting Upgraded: The federal government is revising its data collection standards to better reflect the American population. Under the changes announced by the Office of Management and Budget last month, federal forms asking people about their race and ethnicity will now combine previously separate questions on race and ethnicity into a single question. Forms will now combine the options for Hispanic and Latino with the other categories and add an option for Middle Eastern and North African (MENA) descent. Specifically, new forms will now have a single list of seven categories: American Indian or Alaska Native; Asian; Black or African-American; Hispanic or Latino; Middle Eastern or North African; Native Hawaiian or Pacific Islander; and white; respondents will be instructed to choose all that apply. Last year the National Council of Nonprofits submitted comments in support of the changes and published the article, Bringing Visibility to Vibrant Communities, to explain how they affect nonprofits and individuals.

- Arts & Cultural Sector Impact on the U.S. Economy: Arts and cultural organizations reached an “all-time high in 2022, contributing 4.3 percent of gross domestic product (GDP), or $1.1 trillion, to the U.S. economy,” according to newly released data from the Arts and Cultural Production Satellite Account (ACPSA). Findings also show that arts and cultural employment “recovered to pre-pandemic levels,” and that between 2021 and 2022, all states and the District of Columbia saw economic benefits from these industries. The U.S. Bureau of Economic Analysis (BEA) also provides state-specific breakdowns of data for arts and cultural economic activity.

- UPDATE: Challenge to Smithsonian Internship Settled: A lawsuit challenging a Latino-focused internship program at the Smithsonian’s National Museum of the American Latino and Institute of Museum and Library Services has been settled. Pursuant to the settlement, the Smithsonian’s National Museum of the American Latino internship description now states that it is “equally open to students of all races and ethnicities, without preference or restriction based on race or ethnicity.” The case had been filed by the American Alliance for Equal Rights (AAER), the same entity that successfully challenged affirmative action in higher education last year.

Worth Reading

- Next U.S. census will have new boxes for 'Middle Eastern or North African,' 'Latino', Hansi Lo Wang, National Public Radio, Mar. 28, 2024.

- Why Accurate Census Data Matter: A Case Study on Asian American Communities in NYC, Louise Liu and Amia Jackson, Asian Americans Advancing Justice blog, Apr. 1, 2024.

- The Fearless Fund, DEI, and Attacks on Philanthropic Freedom, Howard Husock, Chronicle of Philanthropy, Apr. 3, 2024.

- How the Fight Against Inequality Will Save Democracy, Darren Walker, Chronicle of Philanthropy, Apr. 1, 2024.

A Bit of Poli Sci Fun

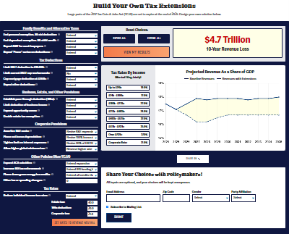

Build Your Own Tax Extensions

Large portions of the 2017 tax law (sometimes called the Tax Cuts & Jobs Act) are set to expire at the end of 2025. The Committee for a Responsible Federal Budget invites you to use their interactive tool to design your own solutions and see the impact of your choices on the federal debt. Options range from letting all expire ($0 added to the federal deficit) to extending all of the 2017 tax provisions (adding $4.7 trillion to the deficit). The interactive tool even lets you share your choices with policymakers.

Worth Quoting

- “Big wins in public policy in the United States capture the popular imagination, animate public discourse, and change society in important ways. … However, these monumental turning points are most often the accrual of decades of deliberate small steps — incremental policy changes — by thoughtful and strategic advocates on the road to the big win.”

— Betting on the Tortoise: Policy Incrementalism and How Philanthropy’s Support Can Turn Small Sustained Steps into Big Impact, William Foster, Marc Solomon, Eric Chen, and Zach Slobig, Bridgespan, April 2024.

Worth Reading

- The Coming Attacks on Nonprofits, Rachel Kleinfeld, Chronicle of Philanthropy, Apr. 1, 2024.

Election Tip

50-State Profiles

Election laws have changed and vary state by state. Differences exist on everything from who administers the elections to voter registration requirements, and from who can vote and when to what voters need to bring with them to the polls. The National Conference of State Legislatures and the U.S. Election Assistance Commission have created an election administration State Election Profile for all 50 states. Nonprofits and the public can use this information to learn about their own state’s voting laws, see how they differ as you cross state lines, and advocate for improvements to benefit your communities. Learn more at New Profiles Offer Bird’s-Eye Views of Each State’s Elections Laws.

Worth Quoting

- “Death threats are not debate. Death threats do not contribute to the marketplace of ideas. Death threats are not a protected constitutional right.”

— John Dixon Keller, Principal Deputy Chief in the Justice Department’s Public Integrity Section, quoted in Federal officials say 20 have been charged for threatening election workers, Yvonne Wingett Sanchez and Perry Stein, Washington Post, Mar. 25, 2024.

Securing ARPA Funds Before It is Too Late

The December 31, 2024, deadline is rapidly approaching for governments to obligate and nonprofits to access State and Local Fiscal Recovery Funds (SLFRF) under the American Rescue Plan Act. Here are some recent nonprofit successes and newly announced opportunities to inspire creativity and advocacy:

- In March, the Warsaw Common Council in Indiana approved reallocating some of the city’s SLFRF funds to the Habitat for Humanity of Kosciusko County for repairs. The Council has found that $40,985 in grants are still available and is giving charitable nonprofits until October 31 to apply.

- Aroostook County, Maine, is transferring SLFRF resources from programs that received little public interest to grant categories that received more requests. As more governments announce plans to reallocate funds, charitable nonprofits have opportunities to contact local officials and advocate for SLFRF investments.

- Oklahoma County, Oklahoma, will reopen its application portal on April 17 and charitable nonprofits will be able apply for funds through May 30. The County is holding an in-person training session on April 10 on How to Navigate the Application Portal and Best Practices for Successful Grant Applications.

- Last week, the City of Greenbelt, Maryland, announced it has extended its Nonprofit Development Grant deadline to August 30.

- The United Way of Walworth County, Wisconsin, will open Round 5 of its Nonprofit Grant program on April 12; the deadline for requesting between $1,000 and $9,000 is June 14.

Learn more about nonprofit eligibility and watch the webinar recording for helpful tips on how nonprofits can access these funds on which governments must commit to specific spending plans by the end of this year.

Workforce Shortages and Public Policy Solutions

Nonprofits continuing to experience a workforce shortage can look to developing public policies and programs such as the following that encourage more people to enter or remain in the sector.

- Child Care: Economic development legislation in Kentucky would establish a Certified Child Care Community Designation Program to increase child care and early childhood education services, benefitting both nonprofit providers and employees. The bill is on the Governor’s desk.

- Paid Family Leave: A bill to expand paid leave for new parents and caregivers of family members has passed the Rhode Island Senate. A Kentucky measure would expand access to paid family leave by treating the benefit as health insurance. Specifically, the measure would authorize insurers to include paid family leave insurance in a group disability income insurance policy or contract purchased by an employer, offered as a supplemental policy provision to a group, or offered as a stand-alone group paid family leave insurance policy.

- Public Service Loan Forgiveness: Legislation enacted in New York and pending in Mississippi excludes debt forgiven under the federal Public Service Loan Forgiveness (PSLF) program from gross income for state income tax purposes. PSLF is a federal program that allows borrowers to earn forgiveness of their outstanding federal student debt after working at an eligible public service job, including at charitable nonprofits, for at least ten years.

Worth Reading

- For families that need the most help, child care costs are about to drop, Chabeli Carrazana, The 19th, Apr 2. 2024.

NYC Advances Pay, Engagement Reforms

The nation’s largest city is taking strides to overcome longstanding grantmaking challenges that have imposed unfair and unsustainable burdens on charitable nonprofits. In March, Mayor Adams announced the investment of $741 million in reimbursements for wage hikes for nonprofit human services providers serving the people of the city on behalf of the government. The 9.27% increase over three years is seen as long-delayed pay raises that past budgeting decisions and bureaucratic hurdles had prevented. Last week, the Mayor announced the creation of a Nonprofit Advisory Council to serve as a link between the Adams administration and the nonprofit organizations serving New Yorkers. The new council “will help inform and guide our policymaking and programming to support the sector.” Explaining the move, Mayor Adams said, “By convening this advisory council, we are making it easier to partner with nonprofits on everything from housing to health care to education.”

Worth Quoting

- “I am mayor of the City of New York today because human services workers were there to support my family when we needed it most. Standing up for these workers as their mayor is not just a professional concern for me; it is personal, too.”

— Mayor Eric Adams, writing in Giving a raise for New York City’s human services workers, AMNY, Mar. 20, 2024.

- “Every New Yorker, in every neighborhood, depends on nonprofits, and nonprofits need to play meaningful roles in problem solving and program development with our government partners. Nonprofit New York looks forward to continuing to work with the Mayor’s Office of Nonprofit Services on the many policy and structural reforms needed to support a robust and thriving nonprofit sector that will benefit all New Yorkers.”

— Chai Jindasurat-Yasui, Vice President of Policy for Nonprofit New York, quoted in Mayor Adams Reveals New York City’s Inaugural Nonprofit Advisory Council, Harlem World, Apr. 2, 2024, acknowledging his appointment to the Mayor’s Nonprofit Advisory Council.

Worth Studying

On Child Care

- What Happens When States No Longer Have Federal Pandemic Child Care Dollars?, Kate Watkins, Rebecca Thiess, and Laura Pontari, Pew Charitable Trusts, Mar. 21, 2024.

Worth Recognizing

2024 Social Impact Women to Watch

Donna Murray-Brown, Vice President of Strategy & Development for the National Council of Nonprofits, has been named one of 25 finalists in the 2024 Social Impact Women to Watch by Nonprofit HR. The honor is presented to those who have demonstrated exceptional leadership, shown a steadfast commitment to their mission and people, and achieved significant accomplishments for the social sector.

Numbers in the News

9 in 10

The share of U.S. adults who say the right to vote, the right to equal protection under the law, and the right to privacy are extremely important or very important to the United States’ identity as a nation.

Source: Election 2024 Poll: Americans are divided, but agree on most core values, AP News, Apr. 3, 2024.

3.8 minutes

The average wait time for New Mexico voters to cast their ballots.

Source: New Mexico conducts elections more reliably than any other state, says MIT project, Albuquerque Journal, Mar. 27, 2024, citing the Elections Performance Index, an assessment tool to evaluate election administration from the Massachusetts Institute of Technology Election Data and Science Lab.

April is

- National Financial Literacy Month

- National Month of Hope

- National Sexual Assault Awareness Month

- National Volunteer Month

Nonprofit Events

- Apr. 12, Annual Member Meeting, Mississippi Alliance of Nonprofits and Philanthropy.

- Apr. 24, Rally for Nonprofit Funding, CT Community Nonprofit Alliance.

- Apr. 24, Allies for Good at the State House, Together SC.

- Apr. 30, Impact Delaware Conference, Delaware Alliance for Nonprofit Advancement.

Using the Powers You Have Series

The Power of Perseverance, Government Grants Edition

The 2024 overhaul of the federal grant rules prove the recently coined adage: if at first you don’t succeed, adjust your strategy and try, try, and keep trying until you achieve your policy goal. Securing additional, nonprofit-friendly reforms to the OMB Uniform Guidance has taken a long time, but the payoff will be significant in the coming years. That’s the nonprofit super power of persistence in support of mission.

Stay in the Loop

Want to be the first to know policy developments and operational trends affecting nonprofits? Sign-up to receive our free newsletters, Nonprofit Champion and Nonprofit Essentials, and browse the archive of past editions.

Sign-up